Hong Kong – February 22, 2021

CBRE is pleased to announce that it has advised on the successful sale of an en-bloc industrial building in Fanling, which is currently serving as a logistics centre with cold storage operations, to Singapore-headquartered real estate investment manager Silkroad Property Partners for HK$321 million. The transaction marks another strong vote of confidence in Hong Kong’s industrial property sector.

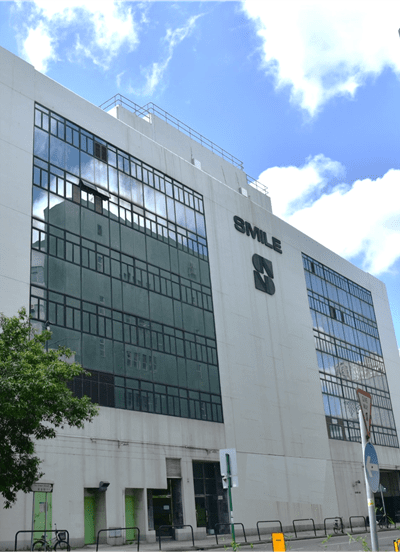

Smile Centre, located at Nos.10&12, On Chuen Street, Fanling, is a 6-storey industrial building with a total gross floor area of approximately 97,750 sq. ft. and a transaction price translating to HK$3,284 per sq. ft. The whole block is currently leased by a renowned logistics player for logistics and cold storage operations and was sold on as-is basis with the existing tenancy. CBRE’s industrial team was appointed as the sole agent by the vendor for the sale of the property.

Fanling is one of the most sought-after locations in Hong Kong for industrial investment opportunities, with its superb infrastructure network providing convenient access to various Mainland borders and Yantian International Container Terminals in Shenzhen. Supply of industrial sites remains limited in Hong Kong, while increasing market demand for industrial properties is driven by the anticipated recovery of global trade and the Chinese economy, as well as e-commerce and 5G technology development.

Samuel Lai, Senior Director, Advisory & Transaction Services – Industrial & Logistics, CBRE Hong Kong said: “We have seen robust investment activities in Fanling, including a recent record-breaking government land tender of an industrial site sold to Mapletree Investments and acquisitions of multiple land plots by a listed data centre developer. Industrial assets continue to attract interest in the market against the pandemic backdrop, owing to the user profiles that will be attracted into the sector. We expect to see more funds chasing quality industrial assets from this year onwards.”

Peter Wittendorp, CEO, Silkroad Property Partners said: “We are delighted to work with CBRE again on the successful purchase of this high-quality industrial asset. The project is the fourth industrial addition to our Hong Kong portfolio, reflecting our strong confidence in the city’s resilient industrial sector.”

For further information regarding the transaction, please contact Samuel Lai, Senior Director, Advisory & Transaction Services – Industrial & Logistics, CBRE Hong Kong (+852 9745 5263) or Ivan Yip, Associate Director, Advisory & Transaction Services – Industrial & Logistics, CBRE Hong Kong (+852 9840 8066). |